The remarkable run of events impacting the markets of late tested companies in ways like no other in perhaps a generation. From the onset of the pandemic in 2020 to rising inflation and supply-chain disruptions in 2021 and the market decline into bear market territory in 2022, companies across all sectors were buffeted by macro events.

Our Investor Communications team recently spoke with Delta Air Lines Vice President of Investor Relations, Julie Stewart, for the first in a series on managing financial reputation that originally appeared in IR Magazine.

As a starting point, can you set the stage for Delta entering 2020?

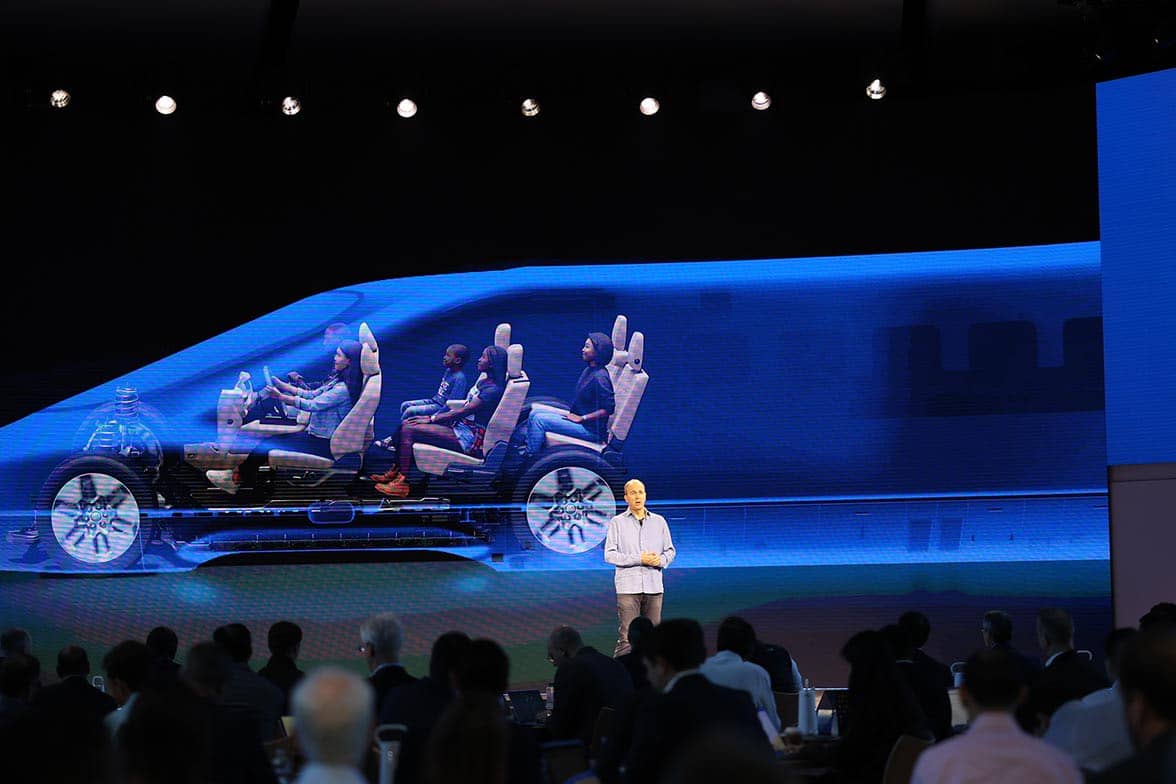

We were coming off our best year ever. Delta had just given the opening keynote at [annual trade show] CES, highlighting the future of travel – the first time an airline CEO had kicked off one of the world’s premier tech and innovation conferences. Delta had a record-breaking year financially in 2019, enabling it to pay out a record $1.6 bn in profit-sharing to our employees.

And it was the latest in several years of consistent performance that significantly outpaced the industry. The shareholder base was strengthening and we were making progress on demonstrating to investors that Delta was in a position to transcend the industry. Then we suddenly found ourselves in a situation that had been unimaginable just weeks earlier, as demand for travel plummeted and our revenues evaporated overnight.

Delta is accustomed to the public spotlight in the normal course of business. Was having that helpful?

Yes, but the challenge was different given the level of fear in the market. One of the things we tried to do consistently was provide investors with the longer-term perspective. Delta is a nearly 100-year-old company with a leading consumer brand.

We’re a very different business from the one we were 10 years ago. Reminding investors of how our business is structurally stronger today helped refocus them on the longer-term opportunities we have in front of us. In late 2021, we laid out a three-year recovery plan to the Street and we’ve been executing well against that, with consistent messaging throughout.

Delta was actively communicating to the public not just on safety issues but also financial issues almost immediately. How did you do that?

We knew we had to be visible and transparent with our employees, customers and owners, especially given the uncertainty we were confronting. We were quick to act in raising capital, adjusting capacity and reducing costs to adapt during the pandemic.

We attended numerous virtual conferences to stay visible with the investment community and update it on what we knew. Our CEO was writing letters to employees more frequently, which we made public in 8K filings, and did a lot of media interviews to continually update consumers on the situation.

In what ways did the IR team build upon management efforts?

Delta is a performance-driven company known for excellence. As an IR team, we work not just to meet that standard for the industry but also strive to be considered one of the best in the profession. We try to be very intentional in our communications and in proactively reaching out to our analysts and largest investors. We pride ourselves on being a knowledgeable, reliable resource that’s consistently available for investors, in all environments.

What intangible skills do you consider particularly useful for communicating with investors?

It’s important to know your audience. In my time as a sell-side analyst, I witnessed management teams that would take a one-size-fits-all approach with investors. There was at times a lack of understanding of differing styles and strategies of the firms they were speaking with from one meeting to the next. Productive conversations start with an appreciation for what the investor is working to accomplish and how it approaches investing. It can be as simple as saying: ‘Tell me about your firm. Tell me about your investment process and what interests you in us’. I’ve found that leads to more productive conversations.

What are the most important lessons you drew from the past few years?

First, I’d say the importance of empathy. The pandemic and turmoil of the last few years has impacted everyone in various ways. Listening and understanding helps build connections and strengthen relationships – at home, at work and with investors.

Second, I’d say the importance of gaining perspective in the business. I had the opportunity to do more of that during the pandemic and gained exposure to different areas of the company, which has made me a better IR professional and better leader at Delta.

Delta hosted a capital markets day in December 2021. Was there any trepidation?

During that period, we were thoughtful as to when to gather investors in person for a company event not only from a health perspective, but also from a visibility perspective. At the time, there was some disbelief in an airline laying out a three-year plan for anything, but we had a strong sense of how we’d strengthened our advantages through the pandemic and the path to full recovery. Investors needed that roadmap, and we had no apprehension in providing it to them.

In hindsight, I am very glad we did. A lot has changed since we laid out our plan – from inflation and rising rates to geopolitical conflict and fuel volatility. Despite the dynamic environment, we came back one year later with 2022 ahead of plan, an outlook for 2023 that was better than many expected and a reiteration of confidence in our 2024 targets. Delta’s willingness to commit to future targets in such an uncertain time speaks to the resilience of the business.

How do you keep investors focused on the investment rationale when the markets are gripped by fear?

It’s important to acknowledge the fears of investors first and not be dismissive. Then, as soon as it’s appropriate, pivot and tell the story of the path forward. In our case, we understood that normalcy would return at some point so we took advantage of the slowdown to accelerate investments in airport infrastructure, fleet renewal and the development of free, fast Wi-Fi – all actions we knew would yield long-term returns.

Similarly, we take a long-term view toward building relationships. Market dislocations create opportunities for investors that can be patient. And when that happens, we want Delta to be at the top of people’s best ideas lists because of our brand, our earnings growth and our cash flow.

Any advice for IR teams on competitive tracking of peers and industries?

In addition to IR, my responsibilities cover competitive analysis. Strategy is something I really enjoy and analysing the competitive landscape has been instrumental in my career development. Just as one gains perspective from doing a rotation in a company, a close understanding of the competitive set brings another level of knowledge for IR teams, and providing competitive insights adds credibility. You’re able to better anticipate market reactions. You’re able to have better, deeper conversations with investors. And you’re able to bring perspective that other IR teams can’t provide.

What would you tell young IR professionals developing their skills?

I’ve worked in a number of roles and love IR because it is a mix of quantitative and qualitative skills, ranging from extensive financial knowledge to engaging with colleagues across the organisation. It’s challenging and demanding at times, but also very rewarding. I also think there are several different paths to find success in this career. A quality that certainly helps is intellectual curiosity. In this role, you have incredible access to information from across the company. While you’re getting the answer you need to communicate with investors and ask three or four follow-up questions to really build your understanding.

In addition, get out there and explore your company, whether it’s through a rotation or simply spending a few days in another department or region. I think you’ll find the different learnings always seem to have an application at certain junctures in your work and career.